Scottish Flexibilities – Your Not So Flexible Friend?

Anger. That was the over-riding emotion I encountered when putting this blog together about Universal Credit.

Anger at a policy causing hardship to tens of thousands of households in Scotland and beyond. Anger at the systems used to fulfil Universal Credit not working properly. This anger stretches beyond practitioners in social housing, Frank Field MP, chair of the Department for Work and Pensions Select Committee, recently wrote to the Secretary of State of Universal Support and National Audit Office (NAO) saying their report, about private debt in the UK, was a “sorry indictment of the benefits policy”. Indeed, responding to the same report Joseph Rowntree Foundation Chief Executive, Campbell Robb, said:

“There are major design flaws in the rollout of Universal Credit which have been left unfixed. Delays and sanctions leave people without enough to live on, and they struggle to pay off debt from advance payments. That’s not right. This system needs an urgent overhaul so that people’s essential needs are met without trapping them in long-term poverty.”

This sentiment goes well beyond in Scotland, with many peers across the UK feeling angry about Universal Credit. However, Scotland is different, the Scotland Act 2016 devolved power to amend housing costs within Universal Credit – the so-called, “Scottish Flexibilities”. These flexibilities enable UC to be paid twice a month (instead of monthly) and for managed payments whereby the rent element of UC is paid direct to the landlord, very much like Housing Benefit. However, to what extent are the Scottish Flexibilities a panacea for the deep-rooted issues around Universal Credit?

The Scottish Flexibilities are well-intentioned and meant to address the serious flaws with the DWP systems and processes, but because of these deep-rooted issues they are limited on the impact they can have. What’s more these systematic problems are also affecting the flexibilities.

Managed payments can take up to 10-12 weeks from date of claim to reaching the rent account, effectively themselves the payment should be made 6 weeks after the claim date.

Jacquie Gardner, Senior Housing Officer at Cairn Housing

One of the first issues raised was the additional delay in receiving rent payments for those on managed payments.

“Managed payments can take up to 10-12 weeks from date of claim to reaching the rent account, effectively themselves the payment should be made 6 weeks after the claim date,” commented Jacquie Gardner, Senior Housing Officer at Cairn Housing.

There is a train of thought that many social landlords will look to default to managed payments, as it is essentially Housing Benefit by another name, although this theory was debunked by many we spoke with. Many cited issues with systems, for example Morag MacDonald, Chief Operating Officer at Melville Housing Association, commented that, “not all claims for managed payments come through.” Moreover, Morag went on to highlight issues around process and systems at the DWP that hinder claims and add delays.

“We recently requested direct payments of rent plus third-party deductions (TPDs) for arrears.”

However, it transpires that the managed payment is dealt with by one department and the TPDs by another. The result was the managed payment was granted but there was no response on the TPD – from the other department, this prompted another enquiry and still there was no response.

Morag also highlighted another issue that they feel TPDs are too high, “they can be up to 40% of the total UC claim. Even, where we request the amount be lowered, the DWP can take time to process the request, and the result of this unfairly impacts the tenants” according to Morag.

Meanwhile the tenant is getting into more and more debt and is suffering significant financial hardship and real mental stress. One of the hardest things we found in our case study reviews was the human impact of getting into debt and simply having nothing to live on – particularly where children were involved.

Morag MacDonald, Chief Operating Officer at Melville Housing Association

I have spoken to dozens of social landlords about Universal Credit, and for this blog alone canvassed opinions from over 10 Scottish RSLs, the overriding sense is that the systems and processes cause many of the issues, and these can be changed at a stroke of a pen, just look how quickly the Westminster Government scrapped the Universal Credit helpline charges after it was raised in Parliament. And for this blog many gave detailed examples of issues they have encountered:

- Managed Payments – missing information on files so difficult to identify which tenancy they belong to

- Landlords find that those tenants who opt for being paid twice a month, rather than monthly, wait longer for their first payment

- Lack of information on the portal which provides less information than the old email system.

- The payment cycles cause issues – Universal Credit is paid monthly but rent payments are every four weeks, so tenants get 12 UC payments but 13 rent statements, this confuses many tenants and often leaves them in arrears

- Examples were also given of whether UC really does incentivise people to work – a 23 year old working 12 hours per week at £7.38 per hour, is offered an additional shift of 4 hours per week. Their net increase in wage, after the 63% deduction would be would be £10.92, assuming no tax and NI is paid. And that’s before you consider the cost of getting to and from work for that shift.

So, what can be done?

Relying on managed payments simply won’t work. There was a long list of requests to improve the current circumstances. A common sentiment was to stop the roll out altogether and sort out the system issues. Other popular comments included change from payment in arrears to payment in advance. What’s more several raised the need for the Landlord Payment Schedule to changed to weekly instead of monthly, as claimants who currently just miss the payment schedule then have to wait several week until the next payment is made.

Do away with Scottish Flexibilities

There was criticism of the Scottish Flexibilities and some even commented that if the way it is currently administered is not changed then they would like to see them scrapped.

The issue remains that with Universal Credit landlords are struggling to identify where they need to focus their resources and which tenancies need additional support, moreover with Universal Credit cases being more complex they take more time to deal with, again eating into resource and time and support for other customers.

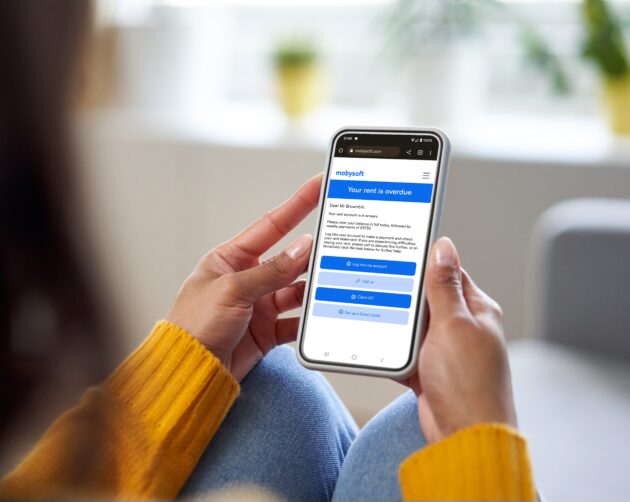

To help counter this many, including seven Scottish social landlords in 2018 alone, have invested in technology systems, like RentSense, to help them focus their resource where it is truly required, at the right time. For many this is invaluable as it is giving their teams more time to support the tenants that need additional support.

But, moving forward will those in positions of power do anything to remedy the current hardship that Universal Credit is causing? The feeling amongst many is nothing will be done and even it is, it will be a long and drawn out process. Therefore, when I write another blog about Universal Credit in twelve months, unfortunately, I expect I will encounter that same feeling of anger.

Be ready for what tomorrow brings.

A RentTest enables landlords to benchmark their data against 170 landlords and see what RentSense would deliver for their organisation